Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Budget 2017: Tax Changes

BUDGET 2017: TAX CHANGES

The 2017 budget lived up to the expectation created by the Finance Minister with the medium term budget policy statement late last year in which it was made clear that R28bn in additional tax revenue must be generated.

Tax increases were announced as follows:

- Introduction of top marginal tax rate of 45% on personal taxable income above R1 500 000;

- Increase in tax rate applicable to trusts (excluding special trusts) from 41% to 45%;

- In consequence of increased top marginal rate for individuals, effective CGT rate for natural persons increased from 16.4% to 18% and in the case of trusts other than special trusts from 32.8% to 36%. The effective CGT rate applicable to companies remains the same at 22.4%;

- Increase in dividends tax rate from 15% to 20%. Effective corporate tax rate is 42.4% from 1 March 2017. Foreign dividends that don’t qualify for exemption will also now have an effective tax rate of 20%; and

- Withholding tax on non-residents disposing of immovable property is increased from 5% to 7.5% for foreign individuals, from 7.5% to 10% for foreign companies and from 10% to 15% for foreign trusts.

SARS’ tax pocket guide, which you can access here, contains a summary of the latest rates for the upcoming fiscal year.

Other tax changes proposed in the budget include:

- Expanding the VAT base to include VAT on fuel. This is in addition to the fuel levy;

- The section 10(1)(o)(ii) 183/60 day exemption for employment income to be amended to allow the exemption only where the employment income is taxed in the foreign country;

- The definition of ‘resident’ to be amended for VAT purposes to address issues with VAT becoming a cost to certain non-resident companies effectively managed and controlled in South Africa;

- The VAT zero rating associated with international travel is expected to be changed;

- Currently VAT is imposed in South Africa upon the supply of certain electronic services and that cloud computing and services provided for by online applications also be subject to VAT;

- Services supplied relating to securities or shares in a foreign incorporated company listed on the JSE should be subject to zero-rated VAT and accordingly changes to the VAT Act should occur to clarify the tax treatment of these services;

- The section 7C amendment to prevent the use of low or non-interest bearing loans to trusts for the transfer of wealth is to include such loans as given to companies owed by a trust. Furthermore the provision will be extended to exclude trusts not used for estate planning and employee share trusts;

- Income Tax Act to allow individuals to elect to retire, and the date on which the lump sum benefit accrued to the individual depended on the date on which the individual elected to retire and not on the normal retirement age. Currently, once the individual elects to retire, the Income Tax Act does not cater for the transfer of lump sum benefits from one retirement fund to another. It is proposed that transfers of retirement interests be allowed from a retirement fund to a retirement annuity fund, subject to fund rules;

- The eligibility threshold for employer provided bursaries and scholarships is to increase from R400 000 per annum to R600 000. The monetary limits are proposed to increase from R15 000 to R20 000 for NQF7 and below and from R40 000 to R60 000 for NQF 7 and above;

- Paragraph 12A of the Eighth Schedule (applicable on reduction of debt) does not currently apply to mining companies. This disparity will be addressed;

- The relief provided in paragraph 12A for dormant group companies or companies under business rescue should be extended to section 19;

- The practice of settling debt by a means other than cash, such as the conversion of debt into equity, is to be allowed. Provision will be made to recoup capitalised interest where an interest deduction was previously claimed;

- Specific countermeasures will be introduced to address share sales disguised as share buy backs;

- Short term shareholding structures aimed at circumventing debt reduction provisions are to be addressed;

- With a REIT’s assets not qualifying as allowance assets in a reorganisation transaction, the legislation will be amended to provide for reorganisation transactions involving REITs;

- Currently the qualifying purpose exemptions for third-party backed shares are too narrow. Provisions are to be further refined to cover all qualifying purposes;

- Refinements to the venture capital company regime, more specifically to investment returns and the qualifying company test;

- Large multinational companies will be required to submit country by country transfer pricing policies to SARS from 31 November 2017;

- Amendments to the Tax Administration Act to curtail inconsistencies arising out of the transitional rules for the calculation of interest on tax debts;

- Only the portion of travel expenses reimbursed by the employer exceeding the fixed distance or rate as determined, is to be regarded as remuneration for the purposes of determining employee’s tax;

- The annual cap of R350 000 on contributions to pension, provident and retirement annuity funds be spread over the tax year for determining monthly employee’s tax;

- Clarification will be made that the chairperson of the Tax Board has the final decision as to whether or not an accountant or commercial member must form part of the constitution of the Tax Board; and

- All decisions by SARS not subject to objection and appeal are to be subject to the remedies under section 9 of the Tax Administration Act.

These and other proposed tax amendments will be discussed in more detail by Nico Theron and Jerry Botha at the SAIT Budget and Tax Update and the SARA Annual Tax Update respectively. For more details, see the links below.

NON-EXECS, PAYE AND VAT: SARS PROVIDES CLARITY

Historically, it was unclear whether amounts paid to a non-executive director were subject to the deduction of employees’ tax and whether the prohibition against certain deductions by salaried employees applied to them. This being as a result of a non-executive directors arguably not earning remuneration as defined in the 4th Schedule to the Income Tax Act. No. 58 of 1962 (“the Act”)

This uncertainty further extended into the application of proviso (iii) to the definition of an “enterprise” as contained in Section 1(1) of the VAT Act, 89 of 1991 (“the VAT Act”), as this proviso excludes from the ambit of VAT the activities of an employee but nevertheless applies to the activities of an independent contractor.

During the 2016 budget speech, it was announced that an investigation into these uncertainties will be launched and clarity provided. This resulted in the issuance by SARS of two welcomed binding rulings. These are, Binding General Ruling 40 (“BGR40”) which deals with employees’ tax implications for a non-executive director and Binding General Ruling 41 (“BGR41”), which deals with the VAT implications.

In terms of BGR40, SARS ruled that non-executive directors do not earn remuneration and therefore amounts paid to them are not subject to employees’ tax. In addition, BGR40 puts it beyond doubt that the prohibition against deductions as contained in section 23(m) of the Act does not apply to non-executive directors.

In terms of BGR41, SARS ruled that non-executive directors may be required to register for and charge VAT in respect of fees earned provided all requirements are satisfied.

While the rulings only apply from 1 June 2017, it is arguable that the rulings merely give effect to what has always been the position under South African tax law.

The implications and practical requirement dealing with non-executive director’s remuneration will be:

- That all non-executive directors will be liable to provide Annual Financial Statement to SARS confirming fees charged when submitting Tax Returns as they carry on a trade.

- When fees received by non-executive directors exceed the threshold they will be liable to register for VAT and submit VAT returns bi-monthly.

Africorp Accountants provides the accounting services required to comply with these requirements and have a registered Professional Accountant, registered with SAIPA South Africa, to sign off Annual Financial Statements.

Our accountant Lelanie Murphy can be contacted on 083 2345 092 for all queries.

SARA Conference – 3 – 4 November 2016

Join us at the South African Reward Association Conference 2016 JHB

Dates: 3 – 4 November 2016

Venue: Vodaworld, Midrand

The conference is CPD accredited with 12 CPD points.

For more information please click here.

Please click here to download the programme.

IPM 60th Annual Convention & Exhibition – 13 – 16 November 2016

IPM celebrated its 70th anniversary in 2015, and once again invites you to celebrate yet another landmark: IPM 60th Annual Convention & Exhibition.

Doing things slightly differently this year, IPM will stage the Annual Convention & Exhibition in the heart of Gauteng – at Emperor’s Palace – and invites you to join an illustrious panel of distinguished local and international speakers, guests, fellow HR Professionals, Business Leaders, Academics, Government Officials as well as young, energetic, out-of-the-box-visionaries who are our modern business leaders.

Background About The IPM Convention

The IPM Convention is Africa’s premier HR and Business Leadership event, hosted annually since 1956. The convention is a three-day cutting edge, content rich conference with hands-on workshops and exhibitions showcasing the leading business solution providers in the People Management field.

It is an event where professionals and business leaders from private and public sectors share a common platform, to explore topical issues, seek solutions to business challenges and network for business opportunities and personal growth. HR stakeholders and business leaders engage on issues and challenges as well as exchange views on innovative approaches around latest development trends in the field of people management and business leadership.

The convention provides opportunities for sponsors and exhibitors to brand their organizations and market their products and services to a captive audience of HR professionals and business executives from both the private and the public sectors.

The IPM Annual Convention and Exhibition has been rated amongst the best globally by the Boston Consulting Group (BCG). The Convention provides speakers with an opportunity to increase their professional profile, to network and to build business connections with HR Professionals and Business Executives from the public and private sectors. You can also attend any of the programme line up to hear from other local and international experts.

The Institute of People Management (IPM) is a SAQA-recognised professional body totally dedicated to promoting and supporting excellent practice in people management and development. We provide a portal of knowledge and tools for strategic people development and leadership, to contribute to growth, profitability and sustainability of business. We are the oldest Human Resource professional body in Africa, and a founding member of the African Human Resource Confederation (AHRC). Through its membership of the AHRC, IPM is affiliated to the World Federation of People Management Associations (WFPMA) www.wfpma.com.

Some of the topics to be covered:

- What are the business models of the future?

- Jobs of the future

- How great businesses approach human capital: 2016 Deloitte Human Capital Trends

- From Disorder and Disruption – The Rise of the Machine

- Business-Labour Relations challenges facing SA and proactive strategies needed to mitigate these

- The Science of Talent Management: Behavioural Literacy

- Leadership lessons from Marikana

- The intrinsic value of a great culture

- Job creation through skills development

- Social Media & Corporate Reputational Risk

- New Learning Culture

- Guarding against obsolescence in learning & development

- Who are your Game Changers? Game Changing HR – Game Changing Organisations

- Utilising disruptive technologies in HR

- Become an ‘Outperformer’: Be prepared for the fourth Industrial Revolution and make sure that the investment in HR becomes an international best practice

- Capitalising on the 4th Industrial Revolution Opportunities in Africa

- Talent Management in Emerging Markets

- The Houston Method – An in depth look at employee engagement

- HR – Gearing the world for the 4th Industrial Revolution, with Great Leadership and Great Culture for Great Businesses.

View/download the conference programme here.

Date: 13 – 16 November 2016

Venue: Emperors Palace – Johannesburg

For bookings, please click here.

Retaining The Talent – Personal & Professional Development

Throughout our lives we are faced with countless challenging decisions, many that influence the pathways we take and where we land on the career ladder. As an employer, and employee, in South Africa we are prone to focus on monetary and tangible elements in our work environment – raises, benefits, travel distance to work, working hours and more, all of which are important to consider, of course. The South African employment market is currently experiencing an economic downturn in terms of employment opportunities, bonuses, salary increases and promotion. As a professional recruiter I experience a daily stream of applications from job seekers – hundreds to be honest – with limited vacancies available. According to Statistics South Africa: “The unemployment rate in South Africa increased to 26.7 percent in the three months to March of 2016 from 24.5 percent in the previous quarter and above market expectations of 25.3 percent. It was the highest reading since September 2005, as number of unemployed rose by 10 percent whereas employment fell 2.2 percent.”

Twenty years ago the limitations in terms of placement were connected to scarce resources and shortages of skilled people, today however, we have many graduated applicants but little opportunity for employment. This in turn leads to educated applicants being unable to obtain valuable work experience and hence, not being selected for the available opportunities. Organisations have started looking for “already experienced, skilled and trained candidates” in order to cut costs in terms of training and development. The result: your most valuable and skilled employees are being poached and head-hunted and retaining the talent becomes an obstacle in itself. With the developed of professional networks such as LinkedIn and Branded.Me this has become even easier. If you are currently a member on LinkedIn you would know that the network even suggests possible job opportunities to you – even if you are not actively looking. So how do you ensure your star-players aren’t grabbed by other organisations?

Neglecting to invest in the personal and professional development of your employees can have dire consequences. Monetary incentives only provide motivation up to a certain point, thereafter factors such as cultural fit, personal growth, recognition, meaningfulness and purpose become more important. Many times we have heard employees complain that “I want to leave my company because I don’t feel like I’m growing” and “I don’t think that I make a difference anymore”. At this stage they have consciously become aware that they have stopped developing personally.

As an employer, showing interest in the professional development of an employee is an important factor to consider. Employees can become disengaged and loose drive, energy and loyalty, inevitably leading to high absenteeism, high turnover rates and an overall negative working environment, to name but a few. According to Pech and Slade (2006): “The phenomenon of employee disengagement appears to be correlated with conditions where there is a lack of psychological identification and psychological meaningfulness.” As humans we are complex and we are driven by different abilities, interests, preferences and ideas. Identifying the strengths and development areas of each employee, on both a personal and professional level, can assist you, as employer, to pin-point exactly what drives and motivates each individual employee. By identifying these motivations we can start to focus on driving performance through personal strengths and enhancing personal development through assisting the employee to address his or her development areas. Employers who are actively taking part in building a culture of engagement in their work environment will foster employee loyalty and retention when other opportunities present itself to the employees (Swindell, 2011). A personal development initiative is one way of actively taking part and investing in the development of your employees.

Investing in a Personal Development Assessment is the first step. Each personal development assessment battery should be tailored to the employee being assessed. This is based on work level, secondary purpose of the assessment i.e. succession planning, type of profession and educational background. Ordinarily an assessment battery consists standard of a personality assessment, cognitive ability assessments and a learning potential assessment. Based on the results of these assessments you can identify individual strengths and development areas. Centred on each employee’s personal assessment scores you are then able to compile a personal development plan (PDP). This is a step-by-step plan to assist the employee to identify own strengths and to be made aware of and understand his/her own development areas.

When considering using psychometric assessments to invest in your employees’ development there are some factors to keep in mind when choosing your service provider. The assessor has to be a registered Psychologist whose scope of work covers workplace assessments, to be on the safe side an Industrial Psychologist can be considered appropriate. They also have to adhere to ethically assessment practices as governed by the Health Professions Council of South Africa (HPCSA) and other relevant South African legislation such as the Constitution of the Republic of South Africa (Act 108 of 1996), the Labour Relations Act (66 of 1995), the Employment Equity Act (55 of 1998) and the Health Professions Act (56 of 1974).

Ethically, this makes sense to both the organisation and the employee, as each employee being assessed is allowed to drive their own development and growth and the PDP is tailored to the individual and not a group. As an employer, Personal Development Assessments are ideal for succession planning, talent management, retention and identifying the diamond-in-the-rough. For the employee, these assessments are ideal for career guidance, study guidance, overall personal development and promotes feelings of importance and recognition. According to Solomon and Sandhya (2010) investing in your employees’ development and growth directly influences a decrease in absenteeism and leads to increased levels of employee engagement and loyalty. In short – a little investment can go a long way…

References

Pech, R. & Slade, B. (2006). Employee disengagement: is there evidence of a growing problem? Handbook of Business Strategy, 7(1), 21 – 25.

Swindall, C. (2011). Engaged Leadership: Building a Culture to Overcome Employee Disengagement, (2nded.) (pp. 3-7) Cintro Publishers.

Markos, S. & Sridevi, M. S. (2010). Employee Engagement: The Key to Improving Performance. International Journal of Business and Management, 5(12), 89 – 96.

The Thinker and the Feeler

Understanding how your employees, team and project members think is one of the key success drivers of managing resources and creating a strong team that work efficiently together to achieve strategic objectives. It takes more than dolling out a couple of high-fives at a team building event to produce a well-oiled team. Clashing opinions and egos can spark off internal politics, create despondence and lower morale. Understanding how someone approaches their day-to-day tasks, communicates with others and deals with pressure and conflict is key to a managing an effective team, especially on executive level.

The cognitive processes we deal with every day are vast and each individual may approach decision-making differently. The Myers Briggs Type Indicator® (MBTI®) distinguishes between two main facets that influence the decision-making preferences: The Thinking preference and the Feeling preference. According to the MBTI we all have inherent preferred behaviours closely linked to our personalities. Therefore, it is reasonable to say that in the current workforce profile of today, made up of various generations, ethnicities and cultures may create the room for misunderstanding between one another if awareness of this concept is lacking.

Quenk and Kummerow (2011) identified the Thinking individual as logical, reasonable, questioning, critical and tough. Whereas the Feeling individual would be empathetic, compassionate, accommodating, accepting and tender. The Thinker would ideally make decisions and judgments on what they “think” would be the best course of action and what would deliver the best objective result. The Feeler would make decisions and judgements on how these will make other people “feel” or what the subjective consequences would be.

When considering your own work environment it may now be possible to start to distinguish between these two kinds of decision-makers based on what drives their decisions. The Thinker, for example, would focus on the reason and logic behind a conflict situation and would be able to separate the person from the situation. The Feeler would find it difficult to keep the conflict separate from the person involved and may take such conflict personal.

It is however important to know that we each have a degree of one or the other decision-making preference. You can be an extreme Thinker or a moderate Thinker – it’s all based on the level of intensity connected to your preference. Just the same you can be overly empathetic or slightly empathic. It is also possible that with time and experience you can learn to behave both as a Thinker and a Feeler, although you would still have your natural preference for either the one or the other. A Feeler, for example, can learn to look at a decision objectively and a Thinker can learn to be accommodating when the situation arises.

Although this insight may help to understand other people’s motives better, we must be vigilant to not place each other in a box. As humans we are complex in the ways we function and we must continue to treat each other with respect, even though our manners of decision-making may differ.

References

Quenk, N. L. & Kummerow, J. M. (2011). MBTI Step II User’s Guide: Practitioner’s tool for making the most of Step II interpretations, (1sted.) (pp. 16-18) CPP, Mountain View: California.

New Financial Developments in the Pipeline after the Budget Speech

1. Outward Remittances

The Government is well aware of how expensive it is to remit funds abroad from South Africa. In response, Treasury will conduct some reforms, to apply, which, together with more competition and exemptions in the Financial Intelligence Centre Act (2001), should hopefully reduce the compliance burden for low-risk remittances and bring lower charges.

2. Financial Surveillance Manual

The current Reserve Bank will publish a simplified financial surveillance manual on its website in July 2016. Banks and other authorised forex dealers are also encouraged to digitise and modernise the current foreign exchange market system.

3. The Ombuds

South Africa has an array of different statutory and non-statutory ombuds, all with different approaches, mandates and processes, across different industries. Government now proposes to merge various the ombuds into a single system. It will be interesting to see how Government homogenises and standardizes their work.

Minimum Wage Deliberations Deadlock

Deliberations around minimum wage in Nedlac which was expected to end next month has resulted in deadlock. Concerns have been raised to whether the deadline around minimum wage will be achievable with a differing views on minimum wage.

Nedlac wants a minimum wage of R5000 where employers want minimum wage to be aligned to the lowest wage sectorial determination, that of domestic workers.

Issues around wage inequalities and slow implementation of minimum wage by the Department of Labour will draw out the final decision and implementation of minimum wage.

Unions as well as researchers and academics believe the minimum wage will not lead to job losses, but will boost consumption-led economic growth and help lift the southern Africa region through higher remittances sent home by migrants working in the country.

Please click button below to read the article published in the International Journal of Human Resources Management which covers a case study on minimum wage regulations in China and the effect on their export capability and economic rise.

[su_button url=”http://34.242.65.225/wp-content/uploads/2015/11/Minimum-wage-regulation-and-firm-export-China.pdf” target=”blank” style=”flat” background=”#e9920e” center=”no” icon=”icon: plus-circle”]Read Article[/su_button]

Medium Term Budget Statement – Tax Essentials Synopsis

o The first automatic exchange of information between tax jurisdictions took place in September 2015. The system is aimed at assisting revenue authorities across the globe with combatting base erosion and profit shifting.

o South African taxpayers who has been using offshore bank accounts to evade South African tax will be well advised to seek professional assistance in regularising their tax affairs as soon as possible.

o Employment Tax Incentives in the amount of R3.9billion has been claimed by 36 000 employers for 250 000 employees.

o While the sunset clause for the incentive currently remains at 1 January 2017, the take up appears good after a slow start on commencement of the incentive on 1 January 2014. We are yet to see whether or not the incentive will be extended. The report from the Davis Tax Committee on the role of incentives in corporate tax will no doubt have an impact on this decision.

o The much anticipated draft carbon tax bill is expected to be released for comment in October 2015.

o Increase in the VAT rate is still being considered as an option to fund key elements of the National Development Plan

o With South Africa’s VAT rate being low relative to other tax jurisdictions, an increase in the VAT rate is, in our view, inevitable. However, as stated by the Davis Tax Committee in its first interim VAT report, “an increase in VAT would have a greater negative impact on inequality than an increase in [personal income tax] and [corporate income tax]”(our insertion). Increases in corporate income tax has not been forthcoming (yet) while personal income taxes has already been increased by 1% across all top earning tax brackets. The current delay in increasing the VAT rate could be argued to be politically motivaded.

o The Minister has requested further input from the Davis Tax Committee on wealth taxes

o The Davis Tax Committee’s’ report on estate duty published in July 2015 proposes a few drastic measures which will, if accepted, change the basis on which trusts’ are taxed. The proposal that the flow through principles applicable to trust’s be removed and which will see trust income being subjected to tax at a flat rate of 41% has flared up heated debates across the country. It appears that the Minister has taken notice of this and this can indeed commended.

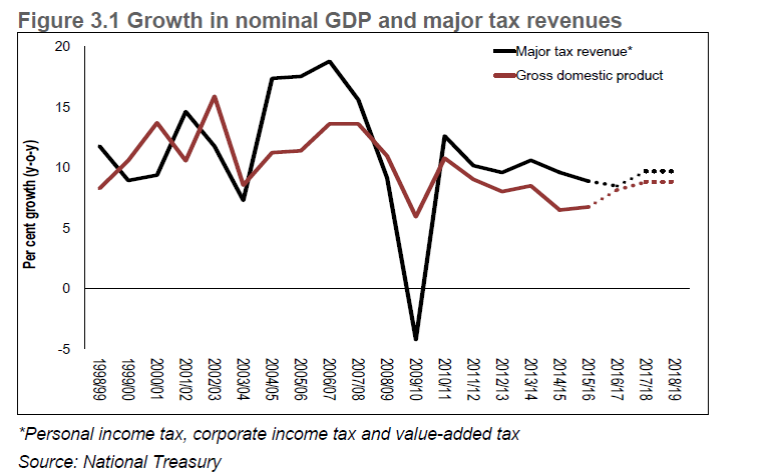

Figure 3.1 from Chapter 3 of the mid-term budget below indicates clearly the stark reality that tax revenues have not only not been restored to levels reached before the 2008/2009 recession, but is also in a downward trend at the moment. The forecast for increased revenue collection, whilst indeed based on increased economic growth, will no doubt place SARS under severe pressure to collect more. Taxpayers will be well advised to ensure their tax affairs are in order and that they are prepared for a more aggressive SARS than what we have come to known over past years.